What Is Trip.com Insurance?

Trip.com insurance is a range of travel protection plans designed to deal with unexpected situations such as travel cancellations, delays, medical emergencies or lost luggage, so that you can relieve the stress of your trip. Whether you are booking flights, hotels or renting a car, Trip.com offers additional insurance (as well as flexible options) to safeguard your plans.

Key Types of Trip.com Travel Insurance

Insurance Type | What It Covers |

Trip.com Flight Insurance | - Trip.com Air Flexibility: Includes the cost of flight changes/cancellations (depending on the airline's policy). - Airline - provided insurance: State - specific policies (US) with coverage details per location. |

Trip.com Hotel Insurance | - Free cancellation support: Filter hotels and "free cancellation" through Trip.com's search filter. |

Trip.com Car Rental Insurance | - Cheaper than rental counters (~20 - 30% savings). - Includes collision, liability, etc. - Free cancellation before pickup. |

Trip.com Insurance for Flights

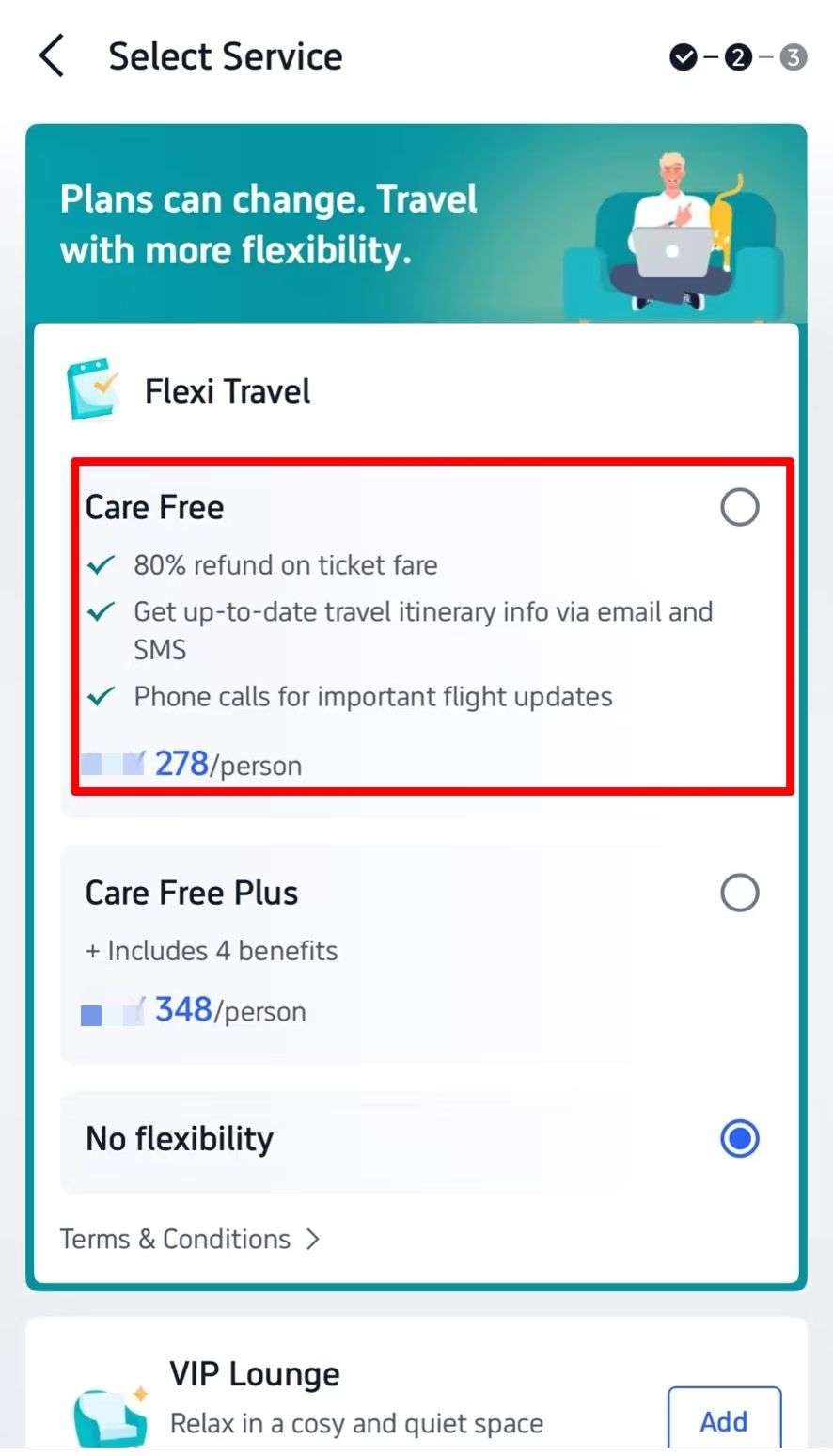

1. Trip.com Air Flexibility

- What it does: If you change or cancel your flight (the airline's policy still applies), it can help you recover your costs. Compensate for the expenses you would otherwise lose.

- How to buy: Select it as an add - on when selecting your flight “package” during booking.

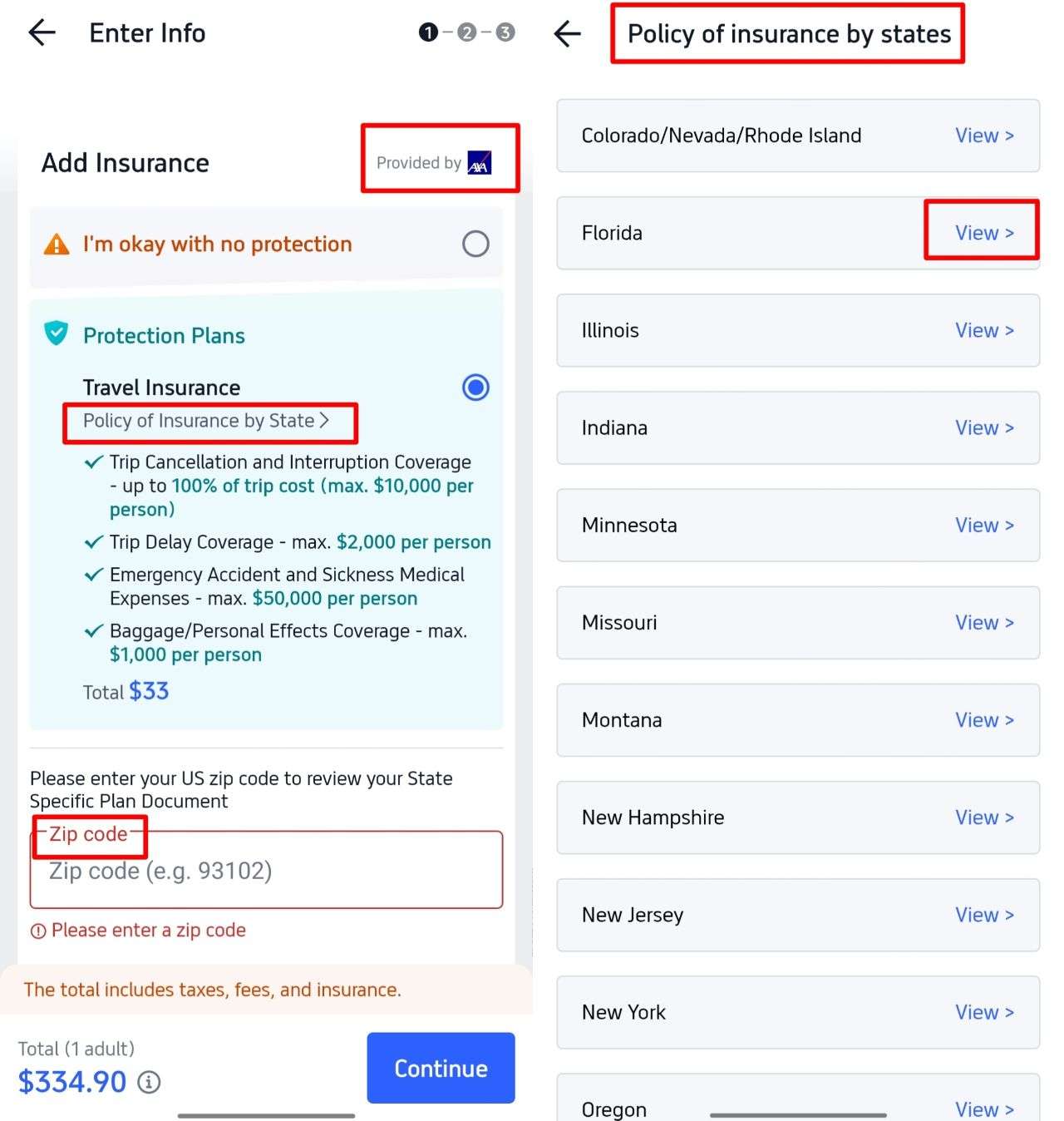

2. Insurance provided by Airlines

This is a flight insurance offered by airlines, and you can choose on Trip.com flight checkout page:

- What is it: This is flight insurance directly provided by the airline and can be obtained during the flight check-in process on Trip.com. Its purpose is to cover travel risks, and the terms can vary depending on your location (especially for American travelers, where specific state rules apply).

- How to buy & use: On the flight booking page of Trip.com, enter your U.S. Postal code at checkout to view the details of each state's customized policies (such as health insurance and cancellation rules). Or manually check "By State Policy" to understand the terms and then purchase an insurance policy that meets your needs.

Trip.com Insurance for Hotels - Filter Free Cancellation

Trip.com makes it easy to protect hotel bookings:

- Free Cancellation Filters:

- On the hotel search page, click “Popular Filters.”

- Select “Free Cancellation” and hit “Show Results.”

- Why use it?: Plans like “Care Free” (for flights) also pair well with flexible hotel bookings—so you can cancel or change without losing money if plans shift.

[8% Off] Global Hotel Recommendations

You can claim the 8% Off hotel coupon below, so that you can save more!

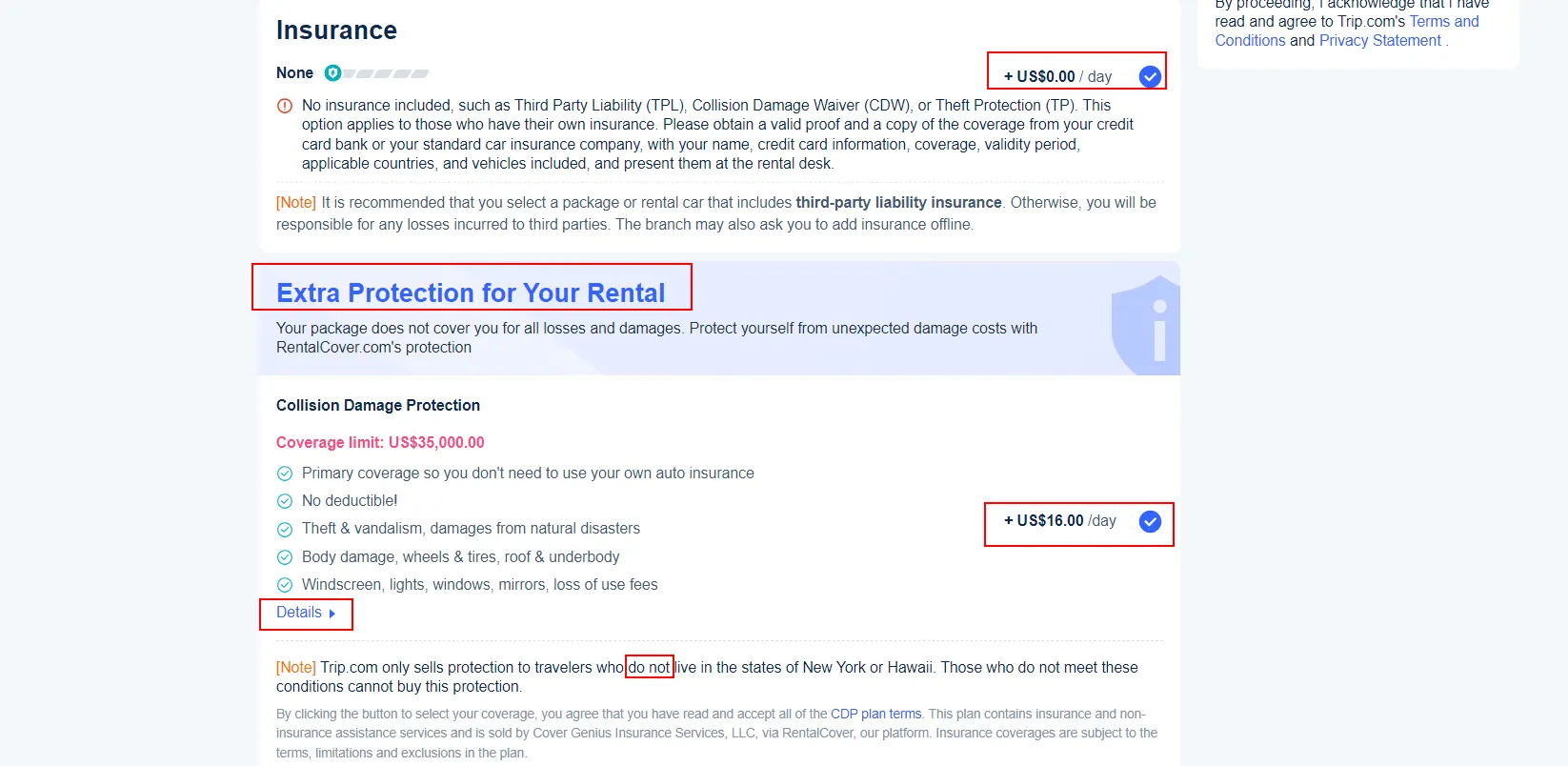

Trip.com Insurance for Car Rentals

Here's how to Buy Trip.com Car Rental Insurance:

- Search: On the car rental page of Trip.com, enter the pick-up location (such as the airport), date, the country where your driver's license is located and your age. Click "Search".

- Select a car: Select a car and then scroll to the "Insurance" section on the details page.

- Select insurance coverage: Choose Trip.com's insurance (cheaper than at the car rental counter) or select a package of insurance (such as collision insurance, liability insurance). For detailed information, such as "Collision damage protection up to US$35,000 per day, no deductible".

- Confirmation: Enter the driver's information (name, driver's license, age, email, phone number, and postal code) to complete the reservation.

How to Claim Trip.com Insurance

This is the general claim process for flight/hotel /car rental insurance on Trip.com for your reference only:

- Immediate Reporting: Contact your insurance provider immediately after an incident (cancellation, delay, damage).

- Document Collection: Gather:

- Booking confirmations (flight, hotel, car).

- Medical records (if applicable).

- Baggage loss/delay reports.

- Cancellation notices from airlines/hotels.

- Online Submission: Use Trip.com’s claim portal or the insurance partner’s site. Upload the file and fill out the claim form.

- Review: Claims usually take 5 to 10 days. Insurance companies may inquire for more information via email. The program usually completes the initial review within 24 hours.

Why Purchase Trip.com Travel Insurance?

Booking a flight ticket or hotel is just the beginning of a great trip. However, unforeseen events, such as travel delays, cancellations or medical emergencies, may disrupt your plans and cause financial losses. Trip.com insurance collaborates with insurance companies to offer travel insurance products covering various situations, including:

- Trip Cancellation and Interruption: If you have to cancel or shorten your trip, you can get a reimbursement of up to 100% of the trip cost (up to $10,000 per person).

- Trip Delay Coverage: If your trip is delayed, each person can receive up to $2,000.

- Emergency Medical Expenses: During your trip, insurance coverage of up to $50,000 per person is provided for medical expenses related to accidents and diseases.

- Baggage/Personal Effects Coverage: Max $1,000 per person for lost, stolen, or damaged belongings.

With such protection, you and your family can travel with peace of mind.

FAQs about Trip.com Insurance

How do I file a claim with Trip.com travel insurance?

Contact Trip.com or the insurance provider as soon as possible after an incident occurs. Gather all necessary documentation, such as medical reports (for medical claims), proof of trip cancellation (e.g., airline or hotel cancellation notices), receipts for expenses, and any other relevant paperwork. Follow the claim submission process outlined by the insurance provider. This usually involves filling out a claim form and submitting the documentation.Can I cancel my travel insurance on Trip.com?

The ability to cancel travel insurance depends on the terms of the specific plan. Some plans might allow cancellation within a certain period (like 14 days after purchase) for a full refund. After that, cancellation might not be possible or might result in a partial refund. Review the cancellation policy of your chosen Trip.com insurance plan.Is Trip.com Insurance Worth It?

Yes—if you want peace of mind. Here’s why: Flight changes/delays: Reimburses costs or offers flexibility (e.g., “Care Free” plan gives 80% ticket refund). Medical emergencies: Covers unexpected sickness/injury costs (up to $50,000 for some plans). Baggage loss: Protects your belongings (e.g., up to $1,000 coverage for lost bags). Car rentals: Saves money vs. buying at the counter and covers gaps in rental company insurance.What is Trip.com Air Flexibility?

Trip.com Air Flexibility helps recover costs if you change/cancel flights (airline policies still apply). Compensates for fees you’d otherwise lose.How do I know which travel insurance is right for me?

- Consider your trip details: If you're going on an expensive international trip, you might want comprehensive coverage that includes trip cancellation, medical expenses, etc. For a domestic weekend getaway, a more basic plan with trip delay and baggage coverage might suffice.

- Check your destination: Some destinations have specific health risks or travel regulations. Make sure your insurance covers any unique situations at your destination. Review your existing coverage: Your credit card or other insurance might al

- Review your existing coverage: Your credit card or other insurance might already provide some travel protections. Coordinate with Trip.com insurance to avoid duplication and get the best overall coverage.

Does Trip.com travel insurance cover pre-existing medical conditions?

Coverage for pre-existing medical conditions varies by plan. Some plans might offer limited coverage or have specific requirements (like purchasing the insurance within a certain time frame of booking the trip). Always check the plan document carefully to understand the coverage for pre - existing conditions.

NO.1

NO.1