Tax-free Shopping in Japan

Who is Eligible for Tax-free Shopping in Japan

| Eligibility and Conditions for Japan VAT Refund | |

| Eligibility for Japan VAT Refund | For foreign national: – A person with a residence status of Temporary Visitor's Visa, Diplomat Visa, or Official Visa – A person who has entered Japan foless than 6 months –Dependents of members of the U.S. armed forces and components who have a SOFA stamp in their passport For Japanese national: – Japanese who have been living abroad for 2 years or more, and had returned home temporarily less than 6 months |

| Japan VAT Refund Period | Only on the date of purchase |

| Location for Refund | Tax-free Shops, Airports, or Tax refund counter |

| Necessary Items | Receipt of purchased goods, Passport of the person who made the purchase (copies are unaccepted, must have a verification seal for landing), Purchased products, Credit card (only if used) |

Step-to-step Guide to Japan VAT Refund Procedure

Before Shopping:

- 1. Check Your Eligibility: Ensure you are a temporary visitor to Japan (staying for less than six months) and have a temporary visitor stamp or sticker in your passport.

- 2. Know the Requirements: There are two types of tax-free purchases: Consumable items (like food, beverages, cosmetics) and General items (like electronics, clothing, jewelry). Each has different rules and minimum purchase amounts.

While Shopping:

Source: from Tsuruya

- 3. Shop at Tax-Free Stores: Look for stores displaying a "Japan Tax-Free Shop" logo. Not all stores offer tax-free shopping.

- 4. Inform the Staff: Before making a purchase, tell the store staff that you would like to buy items tax-free.

- 5. Present Your Passport: You must show your passport (not a photocopy) to the staff. They will use it to confirm your temporary visitor status.

- 6. Make the Purchase: Ensure your purchase meets the minimum amount required for tax exemption, which is typically 5,000 JPY for consumable items and 5,000 JPY for general items (these amounts must be spent in the same store on the same day).

After Shopping:

- 7. Keep All Receipts and Forms: The store will provide you with a purchase proof document and may either give you an immediate refund or attach the purchase proof to your passport for a later refund at the airport.

- 8. Keep the Goods Unopened: If you've purchased consumable items, they must remain unopened and unused until you leave Japan. They are usually sealed in a special bag.

At the Airport:

- 9. Customs Inspection: Before checking in for your flight, go to the customs counter and present your passport, boarding pass, purchase proof, and the purchased items. The customs officer will verify your purchases and stamp the necessary documents.

- 10. Get the Refund: If you haven't received an immediate refund at the store, proceed to the tax refund counter at the airport after clearing customs. Show the stamped documents to claim your refund. The refund may be given in cash (Japanese yen), credited to a credit card, or through other payment methods.

💖Important Tips💖

- Keep all receipts and documents safe until you have completed the refund process.

- Be aware of the time it might take to process the refund at the airport, and allow extra time before your flight.

- Some airports may have different procedures or designated areas for tax refunds, so follow the airport's signs or ask for assistance if needed.

- If you use the items or break the seal on the consumable goods before leaving Japan, you may not be eligible for the refund.

Enjoy Unlimited Connectivity in Japan with Japan eSIM

Japan VAT Refund Location

In Japan, the VAT (Value Added Tax), or consumption tax, can be refunded for tourists under the "Tax-Free Shopping" scheme. Here's where and how you can get the Japan VAT refund:

- 1. Tax-Free Shops: Many stores in Japan offer tax-free shopping to tourists. These shops usually display a "Tax-Free" sign on their storefront. The store will often provide the refund on the spot, either by reducing the purchase price by the amount of the tax or by refunding you the tax amount in cash.

- 2. Airports and Seaports: If you did not get a tax refund at the shop, you could still claim it at the airport or seaport when you are leaving Japan. You will need to present your purchased goods, receipts, and passport to claim your refund.

- 3. Dedicated Tax Refund Counters: In some cases, especially in large shopping areas or malls, there may be dedicated tax refund counters where you can go with your receipts and passport to claim your VAT refund.

Dedicated Tax Refund Counter Location

| Area | Location |

| Nihombashi | 2nd Floor, Main Building |

| Shinjuku | 11th Floor, Main Building |

| Yokohama | Basement 1st Floor |

| Osaka | 7th Floor |

| Kyoto | 7th Floor |

| Tamagawa | 3rd Floor, Main Building |

| Omiya | Basement 1st Floor |

| Kashiwa | 3th Floor, Main Building |

| Takasaki | 5th Floor |

| Sakai | 5th Floor |

| Senboku | 4th Floor |

| Gifu | 1st Floor |

| Okayama | 8th Floor |

| JU Yonago Takashimaya Store | 4th Floor, Main Building |

*At the Nihombashi, Tamagawa, Yokohama and Kashiwa Stores you can also claim a tax refund for purchases made at non-Takashimaya tenants in the adjacent Nihombashi Takashimaya Shopping Center, Tamagawa Takashimaya Shopping Center, Yokohama Joinus and Kashiwa Takashimaya Station Mall.

Japan VAT Refund Purchace Amount Requirements

In Japan, not all purchases qualify for duty-free status. Only specific types of products fall under this benefit. Duty-free goods are divided into two groups: General items and Consumables. To qualify for duty-free benefits for General items, your total purchace amount must be 5,000 JPY or more.

On the other hand, to be eligible for tax exemption with consumable items, your spending must range from 5,000 JPY to 500,000 JPY, and the items must remain unopened during your stay in Japan.

It's important to remember that you cannot combine consumables and general items to meet the minimum spending requirement for tax-free shopping. You must reach the 5,000 JPY separately within each category to claim the exemption.

What Items are Eligible for Japan VAT Refund

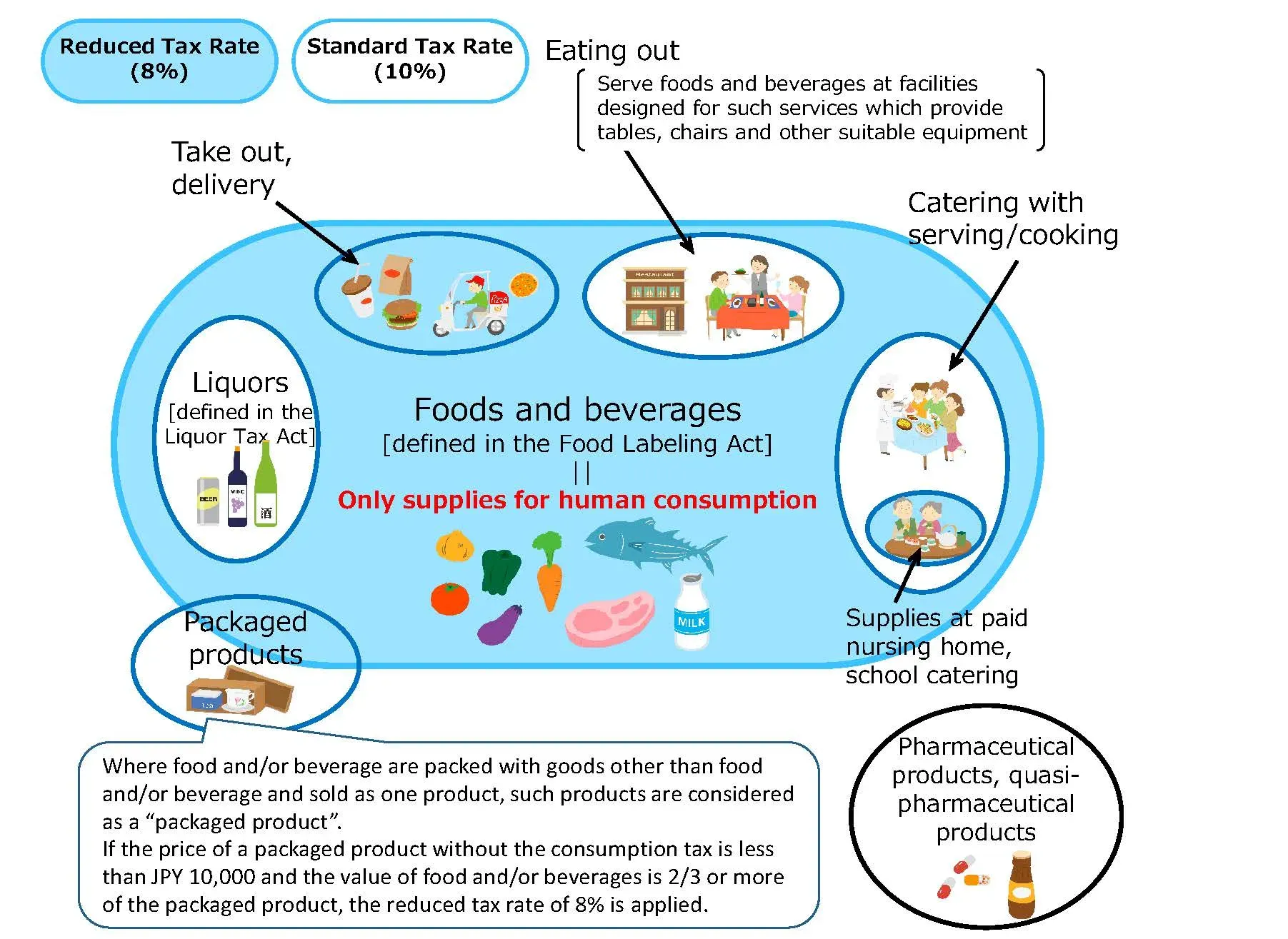

Source: from Ministry of Finance Japan

| Item Types | Detail | Note |

| General goods | Bags, Shoes, Clothing, Watches, Accessories, Home appliances, Souvenirs, Cameras, etc | Purchases of 5,000 JPY or more (excluding tax) |

| Consumables | Cosmetics, Food, Beverages, Medicines, Stationery *Cosmetics case, brush and some of stationery are classified as the general goods | Purchases of between 5,000 JPY and 500,000 JPY (excluding tax) Your consumables will be placed in an official sealed bag. Do not open until you depart. |

Where Can I Do Tax-free Shopping?

| Category | Major Store List |

| Airports | Narita International Airport, Haneda Airport, Chubu Centrair International Airport, Kansai International Airport |

| Department Stores | Sapporo Mitsukoshi (Hokkaido), Daimaru Sapporo (Hokkaido), Tokyu Department Store Sapporo (Hokkaido), Sendai Mitsukoshi (Tohoku), Keio Department Store, Odakyu Department Store, Sogo-Seibu, Takashimaya, Tokyu Department Store, Tobu Department Store, Matsuya Ginza, Isetan Mitsukoshi (Tokyo), Keihan Department Store, Hankyu Department Store, Hanshin Department Store, Abeno Harukas Kintetsu Main Store (Kansai) |

| Electronics Shops | Yamada Denki, K's Denki, Edion, Nojima, Joshin, Kojima x BicCamera, Best Denki, BicCamera, Yodobashi Camera |

| Shopping Malls: | Aeon Mall (Asahikawa Station, Narita, Osaka Dome City, etc.), Mitsui Shopping Park LaLaport (TOKYO-BAY (Funabashi City), Toyosu, Yokohama, Koshien, etc.), Aqua City Odaiba, Tokyo Solamachi, Lumine ( Shinjuku, Yokohama, etc.), Ario (Sapporo, Kansai, etc.), Ito-Yokado (Sapporo, Oimachi, etc.) |

| Stationery | Ginza Itoya |

| Discount Stores: | Don Quixote, Takeya, Niki no Kashi, Komehyo, Mr. Max |

| Drug Stores | Welcia, Tsuruha Drug, Cosmos Pharmacy, Sun Drug, Sugi Pharmacy, Matsumoto Kiyoshi, Daikoku Drug |

| Japanese Brand Stores | UNIQLO, MUJI, Sanrio Gift Gate |

| Airport-style Downtown Duty-free Stores: | Japan Duty Free GINZA (Ginza Mitsukoshi - 8F), Lotte Duty Free Tokyo Ginza Store (Tokyu Plaza Ginza - 8F/9F) |

FAQs about Japan VAT Refund

Who is eligible for Japan VAT Refund?

Generally,temperary visitors to Japan who are staying for less than six months are eligible for a VAT refund on purchases made during their stay.What are the requirements for a VAT refund?

To qualify for a VAT refund, you typically need to make purchases above 5,000 yen in a single day from the same tax-free shops. You must also take the purchased goods out of Japan within 30 days of purchase.Are there any items that are not eligible for a VAT refund?

Yes, some items such as food, alcohol, tobacco, and medicine consumed in Japan, and services like accommodations and car rentals, are not eligible for a VAT refund.Can I get a VAT refund after leaving Japan?

No, you generally cannot claim a VAT refund after leaving Japan. The refund process must be completed before you depart the country.Is there a deadline for claiming a VAT refund?

Yes, you must claim your VAT refund and export the purchased goods within 30 days of purchase.What documents do I need to present for a VAT refund?

You will need to present your passport and the tax exemption form provided by the retailer. You may also need to show the items you purchased.