How to Set Up WeChat Pay for Foreigners in China

Follow these 4 steps (no Chinese bank account needed):

- Download WeChat: Get the international version from your app store.

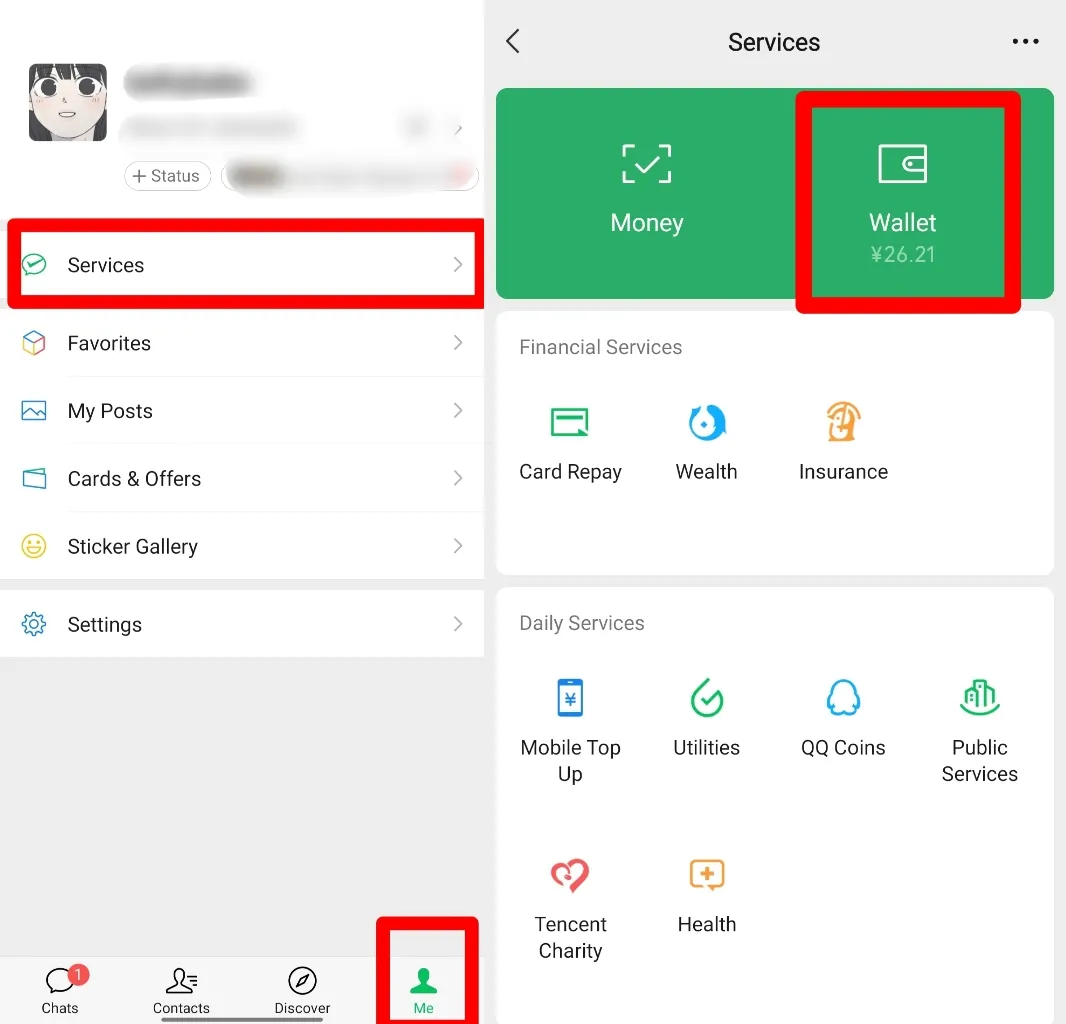

- Activate WeChat Pay:

- Tap Me > Services > Wallet.

- If “Wallet” isn’t visible, go to Me > Settings > General > Features and enable it.

- Verify Identity: Submit a passport photo and personal details.

- Add Your Foreign Card: Visa, Mastercard, JCB, Diners Club, or Discover.

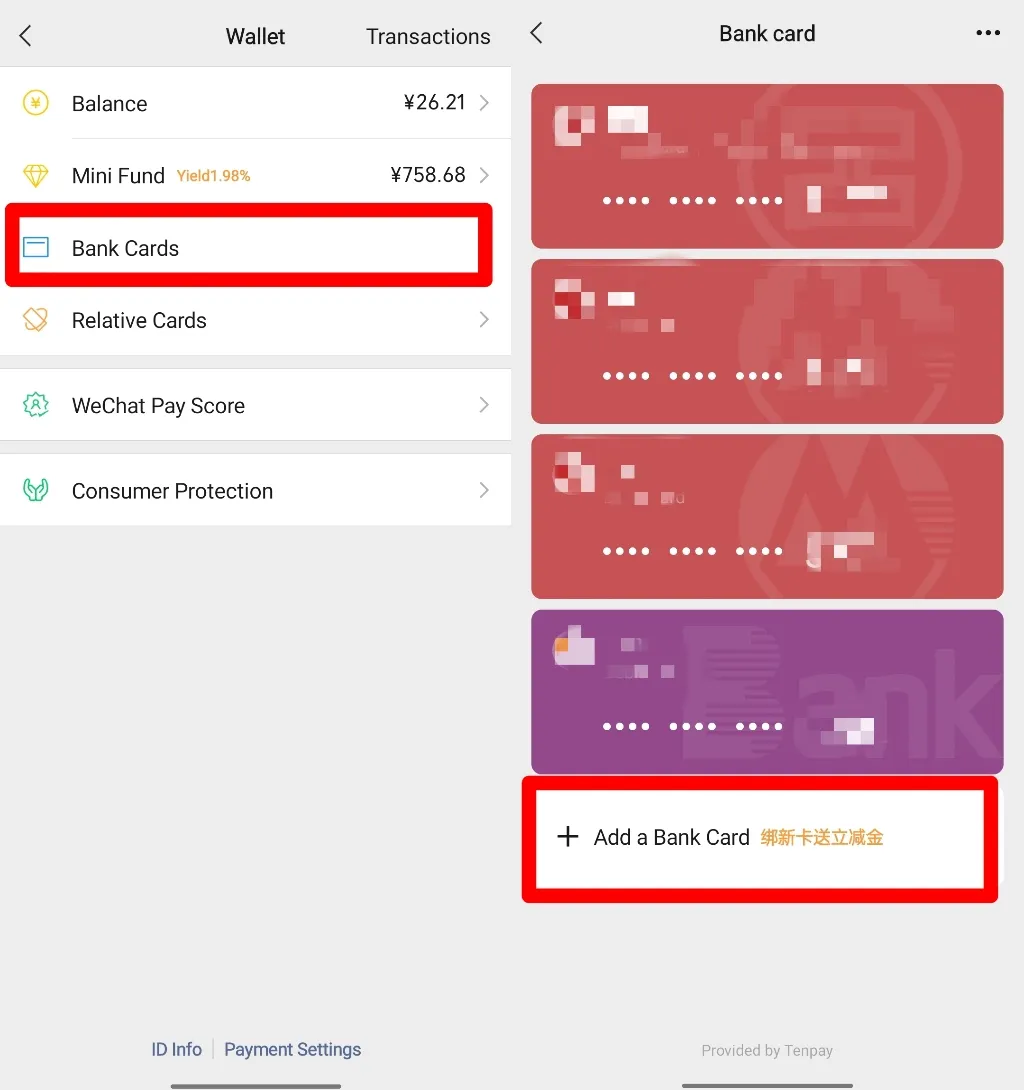

How to Link Foreign Credit Card to WeChat

After setting up your Wallet:

- Tap Bank Cards > Add a Card.

- Enter card details and billing address.

- Complete SMS verification (works with foreign numbers).

- Set a 6-digit payment password.

Note: Some users report needing to upload a passport copy manually via the app.

Instead of juggling VPNs or hunting for SIM cards, China eSIM lets you stay connected to apps like Google Maps, Instagram, LINE and more from the moment you land.

How to Pay with WeChat Pay in China

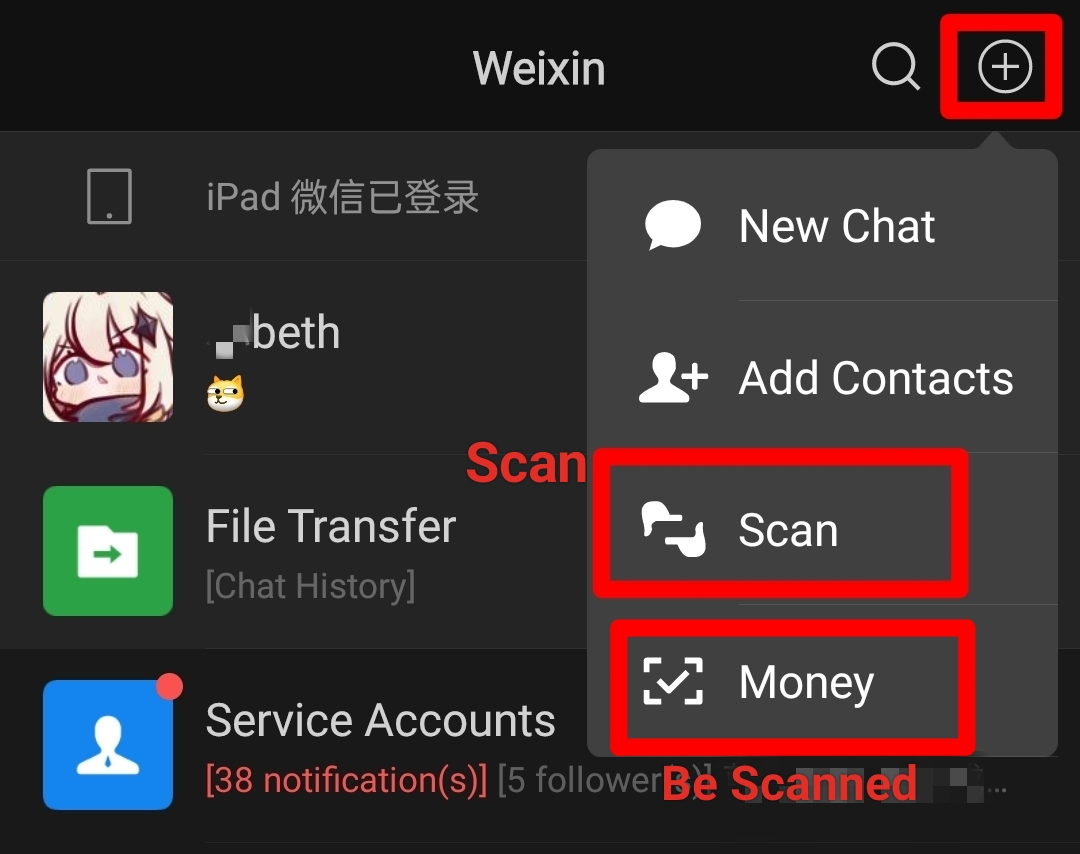

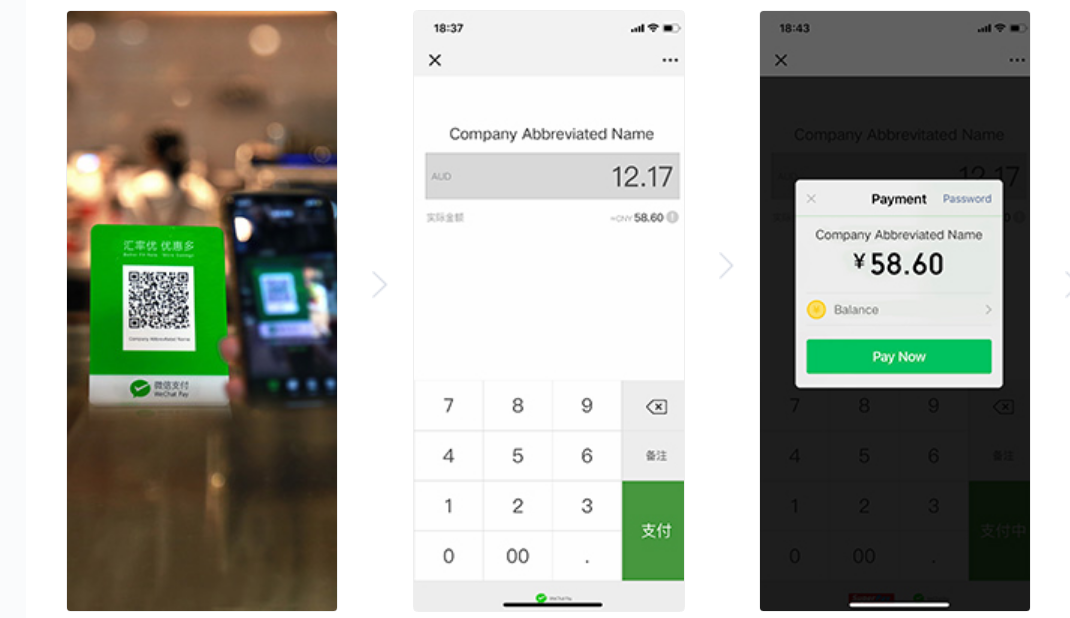

Scan Merchant's QR Codes

Scan codes at stores, taxis, or street vendors. Tap "+" > Scan

Merchant Scan ur QR Code

or Show ur code for merchant to scan: Tap "+" > Money

Are There Transaction Fees with WeChat Pay?

WeChat Pay itself doesn’t charge foreign users fees for transactions. However, your card issuer may apply:

- Foreign transaction fees (typically 1-3% of the amount).

- Currency conversion fees if your card isn’t in CNY.

Pro Tip: Use a card with no foreign fees (e.g., Wise, Revolut) to save costs.

WeChat Pay vs. Alipay: Which Should You Use?

- Choose WeChat Pay if:

- You need social integration (e.g., splitting bills via chat)

- You already use WeChat for messaging

- Choose Alipay if:

- You need robust financial tools (investments, multi-currency accounts)

- You’re a foreigner seeking easier bank integration

- You’re transacting in rural areas or with larger sums

| Criteria | WeChat Pay | Alipay |

| Primary Use Case | Integrated within WeChat app; ideal for social payments, peer-to-peer transfers, and everyday microtransactions | Focused on financial services; preferred for larger transactions, bill payments, and investments |

| Foreign Bank Linking | May require complex verification for foreign users | Direct integration with Chinese banks; smoother setup for international card |

| Acceptance | Widely accepted in urban centers, especially for small purchases | Nearly universal acceptance, including rural areas and smaller vendors |

| Financial Functions | Limited to basic payments and transfers within WeChat’s social interface | Comprehensive tools: investments, insurance, credit services, and multi-currency management |

Can I Use WeChat Pay Without a Chinese Bank Account?

Yes! Since 2023, WeChat Pay allows linking international cards directly. You can:

- Pay at 80+ million Chinese merchants.

- Use QR codes, in-app purchases, and mini-programs.

Limitation: Peer-to-peer transfers (e.g., sending money to friends) may require a Chinese account.

Limitations on WeChat Pay for Foreign Cards

- Spending Caps: Transactions may be limited to ¥5,000/day (varies by card issuer).

- Service Restrictions: Cannot send red packets or use certain social features.

- Currency: Transactions are processed in CNY, so dynamic conversion fees apply.

Is WeChat Pay Safe?

WeChat Pay meets global security standards, including:

- AES Encryption: Protects data in transit and at rest.

- Tokenization: Replaces card numbers with unique transaction codes.

- Biometric Verification: Fingerprint or facial recognition for payments.

- PCI DSS Compliance: Regular audits and real-time fraud monitoring.

460657 booked

460657 booked