Do You Need to Exchange Money in China?

Credit: China Daily

Yes, but how much depends on where you’re going. China’s mostly digital (Alipay/WeChat Pay rule), but cash is still clutch for rural spots, street markets, or if your foreign card glitches.

When You Need Cash

- Rural areas: Many villages/mom-and-pop shops don’t take digital payments.

- Street food/cheap eats: Some vendors only take cash or local QR codes. But that's very rare in China now.

- Backup plan: If your Alipay/WeChat Pay gets frozen (happens to foreigners sometimes).

Swap some cash at banks/ATMs, go digital in cities, keep bills for the countryside.

Best Ways to Get CNY

1️⃣ Banks (Bank of China, ICBC, CCB)

2️⃣ ATMs Use Visa/Mastercard-friendly ATMs (stick to big banks).

3️⃣ Digital Wallets (Alipay/WeChat Pay), Link your foreign card for small spends.

Where to Exchange Money in China

Credit: Wikipedia

Banks > ATMs >>>> Airports/Hotels. Keep your passport handy, avoid getting clapped by fees.

Banks = Your Best Bet Fr

Bank of China, ICBC, China Construction Bank, AgBank. These big bois are government-approved, so no sus rates or scams. PSA: Bring your passport or they’ll ghost you—mandatory for every exchange, no cap.

Hours: Mon-Fri, 9am-5pm. Basic boomer hours. Weekends? Only in mega cities like Beijing/Shanghai, and even then, it’s hit or miss.

ATMs = Low-Key MVP

ATMs in cities take Visa/Mastercard and cough up CNY. Pro tip: Check if your bank back home slaps you with foreign fees (they probably do). Skip ATMs without Visa/Mastercard logos—those things are useless.

Airports = Straight Up Scam Rates

Only use these if you’re desperate (like, “I need taxi cash ASAP” desperate). Beijing/Shanghai airports work, but the exchange rate will make you wanna vomit. Fees? Brutal.

Hotels = Literal Last Resort

Some bougie hotels will swap your cash, but the rates are worse than your ramen budget. Only do this if banks are closed and your cards got declined.

Instead of juggling VPNs or hunting for SIM cards, China eSIM lets you stay connected to apps like Google Maps, Instagram, LINE and more from the moment you land.

How to Exchange Money to CNY in China

Credit: the travel intern

For tourists exchanging foreign cash (USD, EUR, etc.) into CNY, a valid passport is all you need. However, rules tighten if you’re a resident or buying large amounts. Residents/workers → more docs (work permits, tax records).

3 Ways to Exchange Money in China

| Method | Best For | Limits/Fees |

| Bank Exchange | Large sums, best rates | 0.1–0.5% fee; $5k+ requires declaration |

| ATMs | Daily cash needs | ¥2k–5k/day; ~¥30/withdrawal |

| Alipay | Digital transactions | ¥10k/day load limit |

Steps to Exchange Money in China Banks

What You Need:

- PASSPORT: Non-negotiable. No passport = no cash. Period.

- Forms: If you’re swapping over $5k USD (or equivalent), fill out a currency declaration form. Gov’t rule—don’t skip it.

How It Works:

- Walk into any major bank (BOC, ICBC, CCB, AgBank). These institutions have English-speaking staff and streamlined processes

- Hand over your passport and completed declaration form (if applicable). For large sums, be prepared to explain the purpose of the exchange (e.g., travel, business expenses)

- Get your CNY in cash or deposit it into a Chinese bank account (if you have one).

Fees: Banks take 0.1%–0.5% commission. Example: Swapping 1,000 USD? You’ll lose ~1–$5 in fees. Not terrible.

Daily Limit: No official cap, but banks may question large sums (e.g., over ¥50,000/$7,000 USD).

Using ATMs and Digital Apps

ATM Tips

- Withdraw BIGGER amounts to dodge repeated fees. Daily limits are usually ¥2,000–¥5,000, so plan ahead. Use Visa/Mastercard ATMs (look for the logos). Avoid sketchy no-name machines.

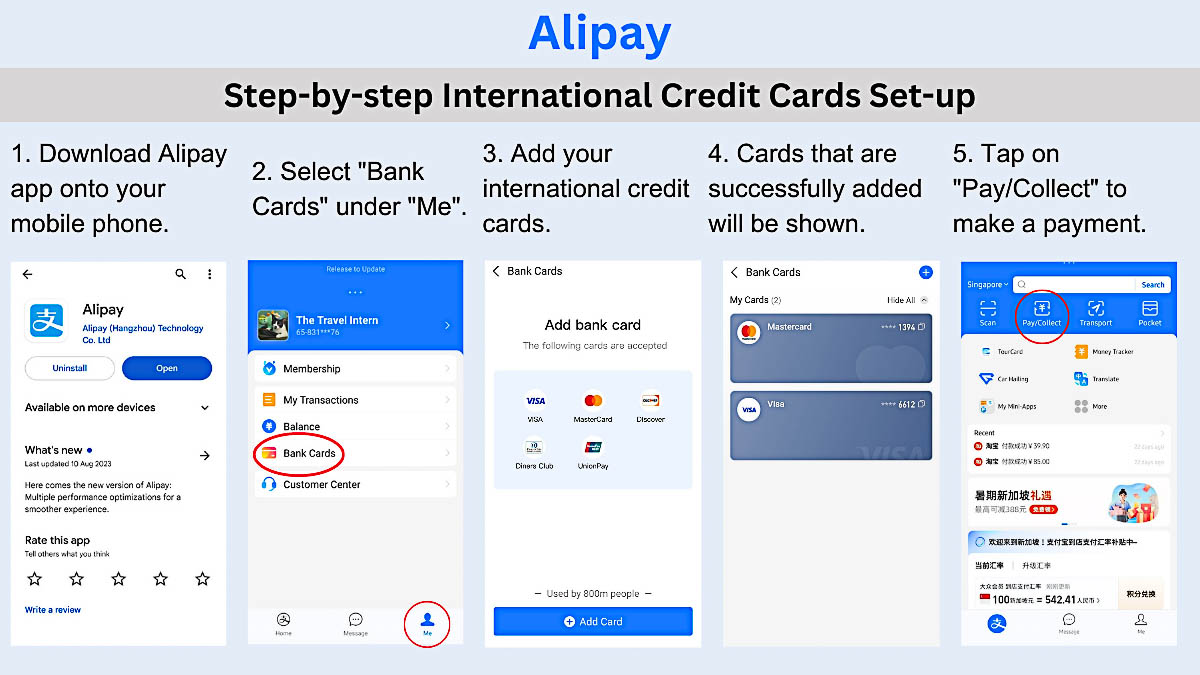

Digital Payment: Alipay/WeChat Pay

- Linking Foreign Cards: Both apps now support major international cards (Visa, Mastercard). For Alipay: Download the app and select “Top Up.” Load funds via your foreign card (daily limit: ¥10,000)

Cash vs. Mobile Payments in China

Alipay and WeChat Pay run 90%+ transactions in China. They’re fast, easy, and accepted pretty much everywhere—even in rural areas now. You can link your foreign card to Alipay (better for tourists) or WeChat Pay, and you’re good to go. QR codes are everywhere—street food, malls, you name it. But heads up: some small vendors might not take foreign-linked cards, so keep some cash handy just in case.

When to Use Cash in China

- Big Purchases (大额): For stuff like art, jewelry, or other big-ticket items, cash or bank transfers are often preferred. Mobile payments have limits, and some sellers just trust cash more.

- Cultural Stuff: During Chinese New Year or weddings, paper red envelopes (红包) are still the move. Digital red packets are cool, but they feel less personal and have limits (like ¥200 for WeChat red packets).

- Emergencies: If your phone dies or the network craps out, cash is your backup plan.

Should I Exchange Money Before Traveling to China?

Umm, yes but not that necessary. Swapping some cash at home maybe convenient—you’ll land with CNY in hand. But rates are usually worse, and airport kiosks abroad charge hefty fees. If you’re carrying USD, EUR, or AUD, you’ll find better rates in China anyway. Still, grabbing a small amount (~¥500) for emergencies (like a taxi or SIM card) isn’t a bad idea.

So just Swap most cash IN CHINA (better rates, ATMs galore). Bring a tiny amount of CNY just to survive Day 1. Pls Go digital (Alipay/WeChat)

| Option | Pros | Cons |

| Swap Before Traveling | Convenient, good for emergencies | Worse rates, high fees, not necessary for USD/EUR/AUD |

| Swap in China | Better rates, ATMs everywhere, digital options | Need passport for banks, rural areas need cash |

China’s banks and ATMs offer better rates, so you’ll get more bang for your buck. ATMs are everywhere in cities, and most accept Visa/Mastercard. Plus, digital payments like Alipay and WeChat Pay dominate—you can link your foreign card for most transactions. Cash is only essential for rural areas or backup.

How to Exchange CYN to Other Currency in China

Credit: china.org

Foreign nationals (including 港澳台居民) in China must provide the following materials to purchase foreign exchange (e.g., USD, EUR) through bank counters (online/mobile banking is unavailable for this service)

Documents Needed

- Valid Passport Original passport (or other valid ID for 港澳台居民, e.g., Mainland Travel Permit).

- Work Permit/Employment Contract Proof of legal employment in China (e.g., work permit, employment contract).

- Salary Payment Records Recent salary slips or bank statements showing income deposits.

- Tax Payment Proof Personal tax records (generated via China’s 个人所得税App or issued by tax authorities).

- Labor Contract Original signed employment agreement (required for verifying income sources).

Notes for Buying Foreign Exchange in China

Post-Tax Income Limit: The maximum exchange amount is based on after-tax income. For example, if your annual salary is ¥500,000 (after tax), you can purchase foreign exchange up to this amount.

Simplified Process for ≤500USD:If you cannot provide the above documents,you may exchange up to 500 USD equivalent with just your passport.

Annual Quota: Foreign nationals with a Foreign Permanent Resident ID qualify for a $50,000 annual convenience quota.

Special Cases

Large Transactions (>$50,000): Additional supporting documents (e.g., proof of overseas education, medical expenses) are required.

For recurring salary purchases, banks may waive repetitive document submissions if verified previously.

For further details, refer to official guidelines from the State Administration of Foreign Exchange (SAFE).

Understanding Chinese Currency (CNY/RMB)

Credit: Wikipedia

What is the Chinese Yuan (Renminbi)?

The Chinese Yuan (CNY), also known as Renminbi (RMB), is China’s official currency. The symbol is ¥, and the currency code is CNY. RMB means "People’s Money," and it’s used for everything in China, from street food to luxury shopping.

Banknotes and Coins in China

Chinese money comes in both paper and metal forms.

| Type | Denominations | Notes |

| Banknotes | ¥1, ¥5, ¥10, ¥20, ¥50, ¥100 | ¥2 exists but is rarely used. |

| Jiao | ¥0.1 (1 jiao), ¥0.5 (5 jiao) | Small change, not commonly used. |

| Coins | ¥1, ¥0.1, ¥0.5 | ¥1 coin is the most common. |

Check Live China Exchange Rate to USD, EUR, etc.

To stay updated on CNY rates, use these trusted tools:

- Wise: Real-time rates with low fees for transfers.

- XE: Reliable for live currency tracking and rate alerts.

- Local Banks: Bank of China, ICBC, etc., offer official rates but may have higher fees.

What Influences China Money Exchange Rates?

The Chinese Yuan (CNY) exchange rate is shaped by a mix of government control and global trends. Here’s what drives it:

- Government Control: China’s central bank (People’s Bank of China) keeps a tight grip on the yuan’s value to stabilize the economy.

- Trade Policies: Trade wars or export/import shifts can impact the yuan’s strength.

- Global Trends: Factors like the US dollar’s performance, inflation, and geopolitical events also play a role.

482609 booked

482609 booked